From Search to Closing: What to Expect When Buying Your First Home in Boone County

Key Takeaways

- The home buying process in Boone County typically takes 30-45 days from offer acceptance to closing, with proper preparation being crucial for success

- Boone County’s median home price of approximately $280,000 requires careful financial planning, including 3-5% for closing costs and potential down payment assistance programs

- Columbia’s college town atmosphere and Boone County’s stable job market make it an attractive area for first-time buyers, but competition remains strong

- Working with a local Boone County real estate agent like Dustin March provides essential market knowledge and negotiation expertise throughout the entire process

- From initial search to final closing, expect to navigate pre-approval, home inspections, appraisals, and various contingencies that protect your investment

Embarking on your first home purchase in Boone County represents both an exciting milestone and a complex process that requires careful navigation. Located in the heart of Missouri and home to the University of Missouri, Boone County offers first-time home buyers a unique blend of stability, growth potential, and community amenities that make it an attractive destination for establishing roots.

The journey from search to closing what to expect when buying your first home in Boone County involves multiple phases, each with its own timeline, requirements, and potential challenges. Understanding this process thoroughly can mean the difference between a smooth transaction and costly delays or complications. This comprehensive guide will walk you through every step, from understanding the local housing market dynamics to celebrating with your new house keys.

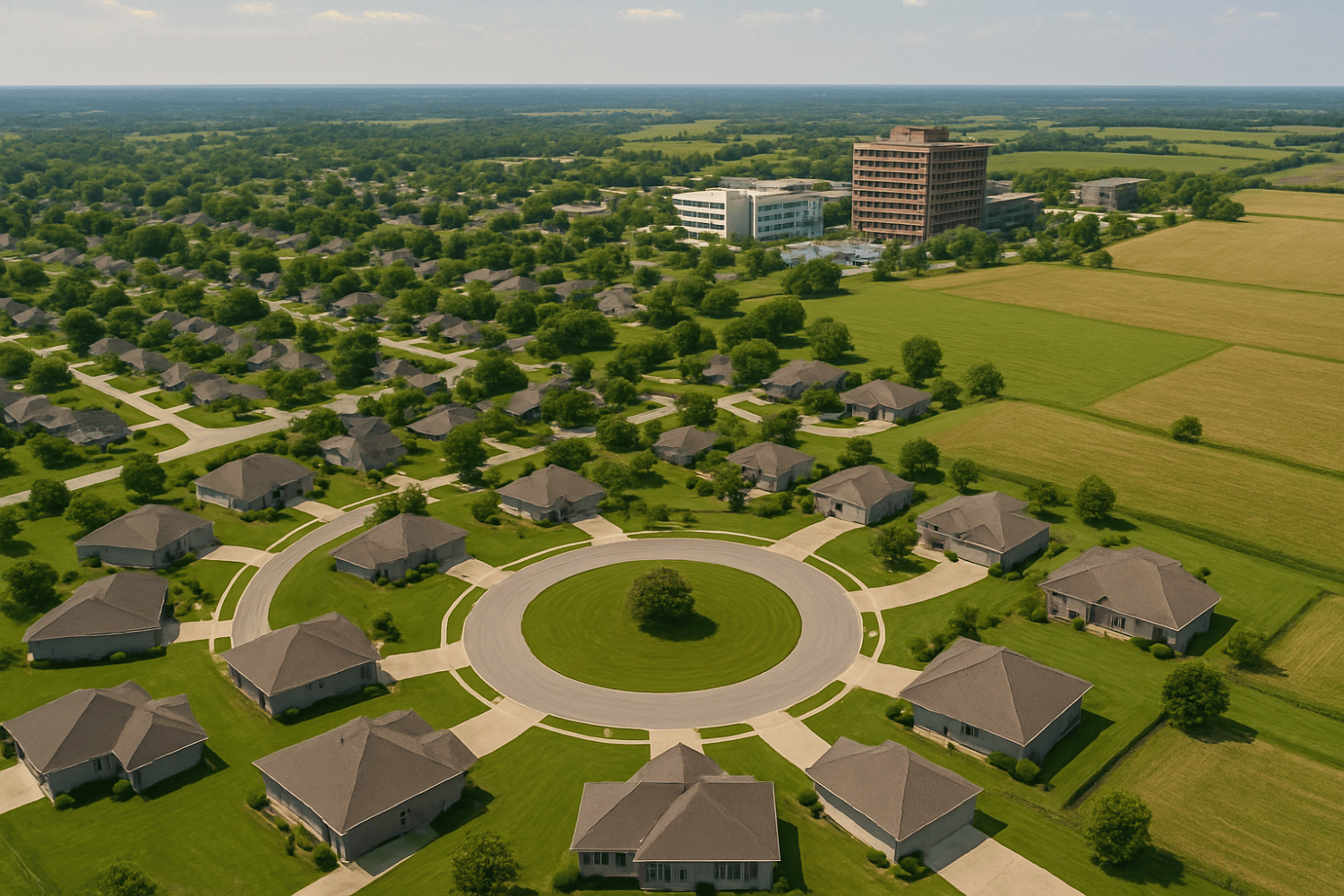

Understanding the Boone County Real Estate Landscape

Boone County’s real estate market benefits from the stability that comes with being home to the University of Missouri, creating a consistent demand for housing that helps maintain property values even during broader economic fluctuations. The missouri housing market in this region reflects both the academic calendar influences and the diverse employment base that extends beyond the university system.

Columbia’s thriving economy supports approximately 120,000 residents, with the University of Missouri serving as the largest employer alongside healthcare systems, government offices, and growing technology sectors. This economic diversity creates a robust foundation for property values and ensures steady demand from both prospective buyers and renters, making it an appealing market for first-time home buyers looking for long-term stability.

Current market conditions in Boone County show inventory levels that generally favor buyers, with homes typically remaining on the market for an average of 47 days. The median sale price across the county varies significantly based on location, with downtown Columbia properties commanding premium prices while suburban and rural areas offer more affordable housing options for budget-conscious first-time buyers.

Price ranges across different Boone County neighborhoods span from approximately $180,000 for starter homes in developing areas to over $400,000 for established neighborhoods near the university campus. The median home value of around $280,000 provides a realistic target for most first-time buyers, though understanding neighborhood-specific pricing trends becomes crucial when determining where to focus your home search.

The impact of university cycles on housing demand creates predictable seasonal patterns throughout the year. Late spring and summer months typically see increased activity as faculty and staff relocate, while winter months may offer more negotiating leverage for prepared buyers. Understanding these cycles helps time your search effectively and potentially secure better deals during less competitive periods.

Preparing Financially for Your Boone County Home Purchase

Financial preparation represents the foundation of successful homeownership, and calculating a realistic budget based on Boone County’s median income requirement of approximately $73,000 ensures you can comfortably afford your monthly mortgage payment while maintaining financial stability. The missouri market requires careful consideration of not just the purchase price, but also ongoing expenses like property taxes, homeowners insurance, and maintenance costs.

Saving strategies for your down payment should account for various loan options available to first-time buyers. While conventional loans typically require 20% down to avoid private mortgage insurance, fha loan programs allow down payments as low as 3.5%, making homeownership more accessible for those with limited savings. The federal housing administration backs these loans specifically to help first-time buyers enter the housing market with lower upfront costs.

Understanding closing costs specific to Missouri becomes crucial for budgeting purposes, as these typically range from 3-5% of the purchase price. For a median-priced home in Boone County, expect missouri buyer closing costs between $8,400 and $14,000. These buyer closing costs include items like title insurance, appraisal fee, lender fees, and various prepaid costs for taxes and insurance.

Credit score requirements vary by loan type, but most mortgage lender programs prefer minimum credit score levels of 620 for conventional loans and 580 for fha first mortgage options. Improvement strategies for better mortgage rates include paying down existing debt, avoiding new credit applications during the home buying process, and ensuring all bills are paid on time leading up to your mortgage loan application.

Missouri-specific down payment assistance programs provide valuable support for qualifying first-time buyers. The missouri housing development commission offers several payment assistance programs, including forgivable loan options that can help cover down payment and closing cost assistance needs. These programs often have varies max household income limits and require complete homebuyer education courses before approval.

Getting Pre-Approved and Choosing Your Lender

The importance of pre-approval in Boone County’s competitive market cannot be overstated, as approximately 86% of sellers prefer offers from pre approved buyers who demonstrate serious intent and financial capability. Pre-approval provides a clear understanding of your purchasing power and streamlines the offer process when you find the right property.

Comparing local Boone County lenders versus national options requires evaluating both rates and service quality. local lender institutions often provide personalized service and deeper understanding of missouri housing market conditions, while national lenders may offer competitive interest rate matching programs. Working with multiple lenders during the initial shopping phase helps ensure you secure the best terms available.

Required documentation for pre-approval includes recent pay stubs, W-2 forms from the past two years, bank statements covering 2-3 months, and valid identification. For self-employed buyers or those with complex financial situations, additional documentation like tax returns and profit-loss statements may be necessary. Having these documents organized beforehand expedites the pre-approval process significantly.

Understanding how multiple pre-approval inquiries within a 45-day period count as a single credit check encourages shopping around for the best mortgage terms without damaging your credit score. This window allows you to compare offers from certified lenders while protecting your credit profile during the home buying process.

Pre-approval letter validity periods typically last 60-90 days, though some lenders offer shorter timeframes. The renewal process for extended searches usually requires updated financial documentation and verification that your circumstances haven’t changed. Planning your home search timeline around these validity periods helps avoid delays when making offers.

Partnering with Dustin March Real Estate

Working with a local real estate agent who understands Boone County’s unique market dynamics provides invaluable advantages throughout the home buying process. Dustin March Real Estate brings deep knowledge of Columbia’s diverse neighborhoods, from downtown lofts to suburban family communities, helping first-time buyers navigate options that align with their lifestyle and budget requirements.

The benefits of local Boone County expertise extend beyond just knowing available properties. Understanding school district boundaries, future development plans, traffic patterns, and community amenities helps buyers make informed decisions about long-term satisfaction with their home purchase. This local insight proves particularly valuable when evaluating properties in different areas of the county.

Dustin March Real Estate navigates Columbia’s diverse neighborhoods with expertise gained through years of market experience. Whether you’re interested in historic downtown areas with walkable amenities, suburban developments with modern conveniences, or rural properties offering more space and privacy, local knowledge helps identify options that match your specific preferences and requirements.

Understanding buyer representation and commission structures becomes particularly important following recent industry changes. Working with a dedicated buyer’s agent ensures your interests remain protected throughout negotiations, inspections, and closing procedures. Clear communication about representation agreements helps establish expectations and protects all parties involved in the transaction.

Access to off-market properties and early listing notifications through local connections often provides competitive advantages in active markets. Real estate agents with established relationships in the community frequently learn about upcoming listings before they reach public databases, giving their clients first opportunities to view and potentially purchase desirable properties.

The coordinated team approach includes relationships with preferred inspectors, lenders, and title companies who understand local market conditions and requirements. This network of professionals helps streamline the process and reduces potential delays or complications that can arise when working with unfamiliar service providers.

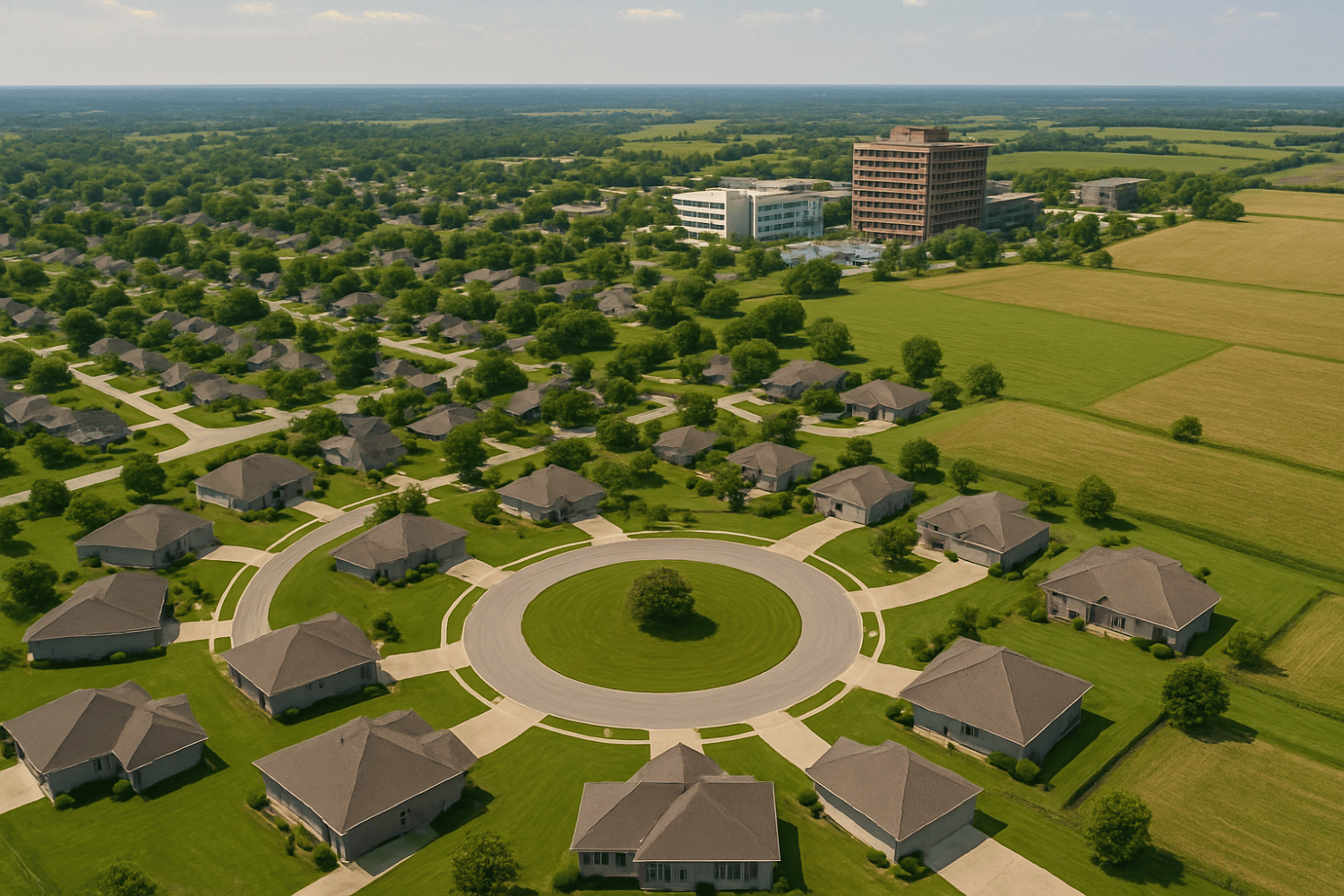

Choosing Your Ideal Boone County Location

Evaluating Columbia neighborhoods based on lifestyle preferences and commute needs requires understanding the distinct character of different areas within Boone County. Downtown Columbia offers urban amenities and walkability, while suburban developments provide family-friendly environments with newer amenities. Rural areas throughout the county offer more space and privacy for buyers seeking a different lifestyle.

School district considerations for families play a crucial role in location selection, as Columbia Public Schools maintain strong ratings that contribute to property values and community stability. Understanding school boundaries and performance metrics helps families make informed decisions about where to focus their home search efforts.

Proximity to the University of Missouri campus significantly impacts property values and rental potential throughout Boone County. Areas closer to campus typically command higher prices but also offer stronger rental markets for buyers who might consider investment opportunities or need additional income to qualify for larger mortgage loan amounts.

Rural versus suburban options within Boone County boundaries offer different advantages for first-time buyers. Suburban developments typically provide municipal services, established neighborhoods, and convenience to shopping and employment centers. Rural properties offer more land, privacy, and often lower property taxes, though they may require additional considerations for utilities and services.

Future development plans and their potential impact on property appreciation deserve careful evaluation when selecting locations. Understanding planned infrastructure improvements, commercial developments, and residential growth patterns helps buyers choose areas with strong appreciation potential for their missouri home investment.

The Active Home Search Process

Using MLS access through Dustin March Real Estate provides comprehensive property search capabilities that go beyond public real estate websites. Multiple Listing Service databases include detailed property information, accurate pricing, and current availability status that helps streamline the search process and ensures you’re viewing the most up-to-date information available.

Scheduling efficient showing tours across multiple Boone County properties requires strategic planning to maximize your time and energy. Grouping properties by location and scheduling back-to-back viewings helps you compare options more effectively while minimizing travel time between properties. This approach proves particularly valuable in competitive markets where desirable properties may receive multiple offers quickly.

When you start house hunting, evaluating homes for condition, layout, and potential red flags during viewings requires systematic attention to both obvious features and subtle indicators of property condition. Look for signs of water damage, structural issues, outdated systems, and maintenance needs that could impact your budget beyond the purchase price.

Comparing properties using market data and neighborhood comparable sales helps establish realistic expectations for pricing and value. Understanding recent sale prices for similar properties in the same area provides context for evaluating asking prices and crafting competitive offers that reflect true market value.

Timing considerations based on seasonal market patterns in the Columbia area can influence both property availability and pricing strategies. Spring and summer months typically see increased inventory but also more competition from other home buyers. Winter months may offer better negotiating opportunities but limited selection of available properties.

House hunting success depends on maintaining realistic expectations while staying flexible about features and locations. Creating a prioritized list of must-have versus nice-to-have features helps focus your search on properties that meet your essential requirements while remaining open to options that might surprise you.

Making Competitive Offers in Boone County

Crafting offers that balance competitiveness with financial protection requires understanding current market conditions and typical negotiation practices in Boone County. In competitive markets, buyers often need to make strong offers quickly, but maintaining appropriate contingencies protects your financial interests throughout the process.

Understanding earnest money requirements helps demonstrate serious intent while protecting your deposit if the sale doesn’t proceed as planned. Typical earnest money deposit amounts range from 1-2% of the purchase price, with funds held in escrow until closing. This earnest money becomes part of your down payment if the transaction closes successfully.

Including appropriate contingencies for inspection, appraisal, and financing protects buyers from potential problems that could arise during the due diligence period. While competitive markets may pressure buyers to waive contingencies, maintaining reasonable protections helps avoid costly mistakes that could impact your financial stability.

Negotiation strategies specific to Boone County market conditions require understanding local customs and typical seller expectations. Working with an experienced real estate agent who knows how sellers in the area typically respond to different offer structures helps craft proposals that stand out positively while protecting your interests.

Response timeframes and counter-offer protocols in fast-moving situations require quick decision-making and clear communication with your real estate agent. Understanding typical response times and having decisions made in advance about your maximum purchase price and terms helps you respond quickly when opportunities arise.

Under Contract: Inspections and Due Diligence

Scheduling comprehensive home inspection within typical 7-10 day periods requires immediate action once your offer is accepted. Professional home inspections provide detailed evaluation of the property’s condition and identify potential issues that could affect your decision to proceed with the purchase or negotiate repairs with the seller.

Understanding Missouri-specific inspection requirements and average costs helps budget for this crucial step in the process. Professional inspections typically cost between $244-$245 for average-sized homes, though larger or more complex properties may require higher fees. This investment provides valuable protection against hidden problems that could cost thousands of dollars after purchase.

Additional inspections for radon, termites, and environmental concerns common in Boone County may be necessary depending on the property’s age, location, and condition. These specialized inspections provide targeted evaluation of specific issues that could impact your health, safety, or future maintenance costs.

Reviewing inspection results and negotiating repairs or price adjustments requires careful evaluation of identified issues and their potential impact on the property’s value and your budget. Major structural or system problems may warrant renegotiation of the purchase price, while minor issues might be addressed through seller repairs or credits at closing.

Managing the appraisal process and addressing potential low appraisal scenarios requires understanding how lenders evaluate property values and what options exist if the appraised value falls below the agreed-upon purchase price. Low appraisals can be addressed through price renegotiation, additional down payment, or appeal processes with supporting market data.

Navigating the Mortgage Underwriting Process

Understanding lender verification requirements during the underwriting phase helps ensure smooth progress toward final loan approval. Mortgage lenders carefully review all aspects of your financial situation, employment history, and the property itself to ensure the loan meets their risk requirements and regulatory standards.

Avoiding financial changes that could jeopardize loan approval becomes crucial once underwriting begins. Major purchases, new credit applications, job changes, or large bank deposits can trigger additional review requirements or potentially derail your mortgage loan approval. Maintaining financial stability throughout this period protects your ability to close on schedule.

Responding promptly to underwriter requests for additional documentation helps prevent delays in the approval process. Common requests include updated pay stubs, bank statements, explanations for unusual deposits, or clarification about employment status. Having these documents readily available expedites the review process.

Coordinating with Dustin March Real Estate to address any approval obstacles ensures all parties work together to resolve potential issues quickly. Experienced real estate agents understand common underwriting challenges and can help coordinate solutions when problems arise.

Timeline expectations for final loan approval and clear-to-close status typically require 7-10 days for final underwriting review after all conditions are satisfied. Understanding this timeline helps coordinate scheduling for final walk-through inspections and closing appointments with all parties involved.

Preparing for Closing Day

Conducting a final walk through inspection 24-48 hours before closing ensures the property remains in the same condition as when you agreed to purchase it. This final inspection verifies that any agreed upon repairs have been completed satisfactorily and that no new issues have developed since your last visit.

Reviewing settlement statements and understanding all closing costs helps ensure accuracy and prevents surprises at the closing table. Your closing cost breakdown should include all previously discussed fees, credits, and adjustments. Questions about any unexpected charges should be addressed before the closing date to avoid delays.

Coordinating utility transfers and homeowners insurance activation ensures essential services are available when you take possession of your new home. Scheduling utility connections and confirming insurance coverage effective dates prevents interruptions in service and protects your investment from the moment you receive your keys.

Preparing certified funds for closing and understanding wire transfer procedures requires coordination with your bank to ensure funds are available in the correct form. Most closing transactions require certified funds or wire transfers rather than personal checks for large amounts, and arranging these transfers may take additional time.

What to expect during the closing appointment at the title company includes reviewing and signing numerous documents, receiving explanations of key terms, and coordinating the final transfer of ownership. Title companies facilitate this process and ensure all legal requirements are met for the property transfer.

Closing Day and Beyond

The document signing process involves reviewing and executing various legal documents that transfer ownership and establish your mortgage obligations. Key papers to retain permanently include your deed, mortgage documents, title insurance policy, and settlement statement. These documents prove ownership and may be needed for future refinancing or sale transactions.

Receiving keys and garage door openers from your new Boone County home marks the official completion of your home buying journey. This moment represents the culmination of weeks or months of preparation, searching, and negotiating to achieve your goal of homeownership in one of Missouri’s most attractive communities.

Post-closing timeline for your first monthly payment typically requires payment within 30 days of closing, though your mortgage lender will provide specific instructions about payment schedules and methods. Understanding when and how to make payments helps establish good relationships with your lender and protects your credit standing.

Immediate homeowner responsibilities include managing property taxes and insurance payments, either directly or through escrow accounts established with your mortgage loan. Understanding these ongoing obligations helps budget for long-term homeownership costs beyond your monthly mortgage payment.

Building relationships with local service providers and neighbors in your new community enhances your enjoyment of homeownership and provides resources for future maintenance and improvement needs. Establishing connections with reliable contractors, service providers, and neighbors creates a support network that proves valuable throughout your time in the home.

Frequently Asked Questions

How long does the entire home buying process take in Boone County?

From initial search to closing typically takes 2-4 months for prepared buyers who have their finances organized and pre-approval completed. The period from accepted offer to closing averages 30-45 days in Boone County, depending on financing type and any complications that arise. The pre-approval and preparation phase can take 2-4 weeks depending on financial complexity, while cash purchases can close in as little as 2-3 weeks without mortgage contingencies.

What are the total costs beyond the down payment when buying in Boone County?

Closing costs typically range from $8,600 to $14,400 for a median-priced Boone County home, representing 3-5% of the purchase price. Home inspection costs average $244-$245, with additional specialized inspections potentially needed for radon, termites, or other concerns. First-year expenses include property taxes, homeowners insurance, and potential HOA fees. Budget 1-2% of home value annually for maintenance and unexpected repairs beyond your regular monthly payment obligations.

Do I need a real estate attorney for my Boone County home purchase?

Missouri law does not require attorney representation for residential real estate transactions, as most purchases use title companies for closing services and document preparation. However, consider attorney consultation for complex situations like short sales, estate transactions, or properties with unusual legal complications. Dustin March Real Estate can recommend qualified real estate attorney professionals when specialized legal guidance becomes necessary for your specific situation.

What makes Boone County different from other Missouri markets?

The University of Missouri creates a stable rental market and consistent housing demand that helps maintain property values during economic fluctuations. Columbia’s economy provides diverse employment opportunities beyond the university system, including healthcare, government, and growing technology sectors. Property values tend to remain stable due to the educated population and steady job market, while seasonal variations in inventory relate to the academic calendar and faculty relocations.

How can I strengthen my offer in a competitive Boone County market?

Obtain a pre-approval letter and proof of funds before making offers to demonstrate serious financial capability to sellers. Consider shorter contingency periods while maintaining necessary protections for inspection and financing. Write personal letters to sellers when appropriate, especially in established neighborhoods where emotional connections may influence decisions. Work with Dustin March Real Estate to structure competitive terms that go beyond just price, including flexible closing dates, earnest money amounts, and other factors that appeal to sellers.